We write today with our thoughts on two topics: the threat of recession and our thoughts on a few recent gloomy articles about prospective returns to a balanced portfolio of U.S. stocks and bonds.

Is a recession imminent and, if so, what does it mean for my investments?

With respect to the first question the short answer is that we don’t know. Nevertheless, we do have some thoughts on the topic.

There is widespread talk that the U.S. and Canada may be entering a period of economic recession. There certainly are some indicators to suggest that economic activity is slowing. We will spare you from repeating the negative stories that portend recession – suffice it to say that there is lots to worry about it. But as we have pointed out in past letters to you, dear reader, there has always been lots to worry about.

One reason that recession angst is more prevalent of late is that the U.S. has been in a period of economic expansion since June 2009 – the longest in history[1]. The human mind is a pattern-seeking device, so it is natural to ask, “Are we due?”

The short answer to that is maybe – but not necessarily. Every market and business cycle is unique.

We are reading a book by Robert Shiller (for those of you who don’t know of him, Shiller is a Nobel Prize–winning economist) called Narrative Economics: How Stories Go Viral and Drive Major Economic Events. In this, his latest book, Shiller explains that the track record of economists, generally, in predicting recessions has been poor. According to Shiller, “No economist gave a credible forecast of the worldwide nature of the Great Depression of the 1930s before it happened, and only a handful predicted the peak of the US housing boom in 2005 or the “Great Recession” and “world financial crisis” of 2007–9[2]”.

Our take: a few investors correctly identified that U.S. residential real estate was in what they believed to be a bubble, but we know of no one who predicted the ripple effect (i.e. the financial crisis). To our knowledge, not a single one.

Shiller cites a Fathom Consulting study[3] as an example of the poor track record of economists in forecasting recession. Here is Shiller describing the results of this study:

“There have been 469 recessions (defined as a decline in a country’s GDP over a year) in 194 countries forecasted since 1988 by the International Monetary Fund in its biannual World Economic Outlook. In only 17 of these did they forecast a recession in the preceding year. They predicted recessions that did not occur 47 times[4]”.

The author of Fathom study, Andrew Brigden sums it up as follows: “like investors, economic forecasters are prone to cry wolf[5]”.

Our take: Our experience, too, is that the track record of prediction on the part of economists (generally speaking) is not good. Accordingly, you can take all of the worrying economic indicators (and forecasts) with a grain of salt. While the trajectory of the economy is important, it’s not knowable. The great investor Peter Lynch advises that “If you spend 13 minutes a year on economics, you’ve wasted 10 minutes[6]”.

Some might think it is a good strategy to get out of stocks in anticipation of a recession or “correction” in stocks. This sounds like a good idea but is impractical owing to the difficulty in predicting the timing of such events. Lynch also advises us that “More people have lost money waiting for corrections and anticipating corrections than in the actual corrections.[7]“

“The End of 60/40”

We have recently noted a few articles pointing to studies about a “bleak” outlook for stock and bond returns over the next decade. Some of these articles also question whether the “classic” or traditional 60/40 balanced portfolio allocation is still wise given the unsatisfactory and far below historic average yields on fixed income securities.

The “60/40” refers to a mix of 60% stocks and 40% bonds (fixed income investments, including GIC’s). Such a portfolio is not suitable for everyone (it is not a one-size-fits-all solution) but this classic mix (or close approximations thereof) represents a common, “balanced” approach to investing.

The reasoning behind the popularity of the 60/40 mix is that, often (but not always) the fixed income component can act as a buffer against the volatility of stocks; there is a potential diversification benefit.

One of these articles is a study by Bank of America strategists Derek Harris and Jared Woodard, titled “The End of 60/40[8]”. In that study the authors argue that due to historic low rates “bonds may no longer provide the portfolio stability and consistency they once did” according to a Globe and Mail summary of the article[9].

The gist of the case against 60/40 is that after three decades of declining interest rates bonds may not provide the same hedge against stock market weakness that they have in the past – and they can’t be relied upon to contribute as much to the overall return (comparatively speaking).

A Forbes contributor summed up the situation in a recent column:

“Investors are used to seeing one of two things happen in their bond portfolios. Either they make a nice rate of return on the interest rate, or they make that return and more, as rates drop and their bond portfolio appreciates further. Fast-forward to today, and the choices for bond investors are not “good returns or great returns.” They are low positive returns or negative returns[10]”.

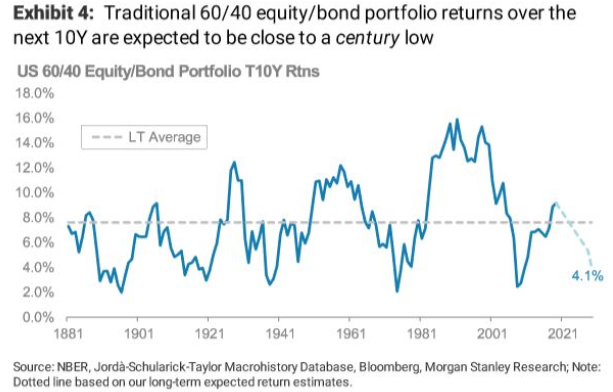

Morgan Stanley strategists Serena Tang and Andrew Sheets also have a grim outlook on the 60/40 portfolio. In a recent note to clients they warned of a “Bleak decade ahead for stock and bond returns[11]”. Their analysis is based on historical valuations for U.S. stocks and bonds[12]. They conclude that, “We expect U.S. stocks and U.S. Treasurys to see [returns of] 4.9% and 2.8% each year, respectively, over the next decade, driving expected returns for a traditional 60/40 equity/bond USD portfolio close to a century low[13]”. Accompanying chart below[14].

Howard Marks summed up the environment quite nicely in an August, 2019 interview:

“In recent years that the macro uncertainties have been large, the prospective returns in most asset classes have been near record lows, asset prices are full and many people are engaging in risky behaviour in order to try and rest good returns from a low return world. If you take those four things: risks, low returns, high asset prices and risky behaviour around us, that tells me we should be more defensive than usual[15]”.

Our take: Fixed income yields (generally) are unappealing to most however short-term fixed income securities and cash-like investments (e.g. high interest deposits or savings funds) can continue to serve an important purpose. They can act as a buffer to the volatility of stocks but more importantly these funds will be on hand to invest when good opportunities arise. We know the opportunity set before us, but we cannot know what the opportunity set will look like in the future.

If or when an economic recession arrives (which is sure to happen but is not predictable), the prepared investor (i.e. those with liquidity) will be in a position to exploit potential opportunities. The silver lining is that bad events (recession, correction, crises, etc.) can be a great time to invest. On this topic we relate to you a parable about a Chinese farmer[16]. We heard this story from Howard Marks so we give him his due credit.

The Chinese Farmer

Once upon a time there was a Chinese farmer whose horse ran away. That evening, all of his neighbors came around to commiserate. They said, “We are so sorry to hear your horse has run away. This is most unfortunate.” The farmer said, “Maybe.”

The next day the horse came back bringing seven wild horses with it, and in the evening everybody came back and said, “Oh, isn’t that lucky. What a great turn of events. You now have eight horses!” The farmer again said, “Maybe.”

The following day his son tried to break one of the horses, and while riding it, he was thrown and broke his leg. The neighbors then said, “Oh dear, that’s too bad,” and the farmer responded, “Maybe.”

The next day the conscription officers came around to conscript people into the army, and they rejected his son because he had a broken leg. Again all the neighbors came around and said, “Isn’t that great!” Again, he said, “Maybe.”

Moral: Adversity can have a silver lining.

Marks also makes a very important observation. That “many people are engaging in risky behaviour in order to try and rest good returns from a low return world“. It is a mistake on the part of investors in our view to chase returns by going further out on the risk curve simply because the markets are not offering or delivering the returns that they need or desire.

This is a mistake in our view. As Marks has wisely counselled, “If there is nothing clever to do it is a mistake to try to be clever”. You can put us on the record in opining that now is a good time to play defense and stick with quality.

The timeless strategy of having a portion of your investments in fixed income securities is not “dead” in our view. Syndicated columnist Chuck Jaffe nailed it in a recent Seattle Times article, “every time the investment world appears ready to give up on conventional wisdom, we find out why the thinking has been conventional and successful for so long[17]”.

Best wishes to you and your family from your Apex team: Shawn, Scott, Mike, John, Will, Denise E., Paul, Tina, Denise N., Lisa, Marta, Darlene and Sharon.

Disclaimer:

The information contained herein was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any securities mentioned. The views expressed are those of the author and not necessarily those of ACPI.

Aligned Capital Partners Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada

[1] “This is now the longest US economic expansion in history”, Yun Li, CNBC, July 2, 2019, https://www.cnbc.com/2019/07/02/this-is-now-the-longest-us-economic-expansion-in-history.html

[2] Narrative Economics: How Stories Go Viral and Drive Major Economic Events Hardcover, Robert Shiller, October 1, 2019

[3] Andrew Brigden, “The Economist Who Cried Wolf.” Fathom Consulting, February 1, 2019, https://www.fathom-consulting.com/the-economist-who-cried-wolf/#_ftn2

[4] Narrative Economics: How Stories Go Viral and Drive Major Economic Events Hardcover, Robert Shiller, October 1, 2019

[5] Andrew Brigden, “The Economist Who Cried Wolf.” Fathom Consulting, February 1, 2019, https://www.fathom-consulting.com/the-economist-who-cried-wolf/#_ftn2

[6] https://www.fidelity.com/viewpoints/investing-ideas/peter-lynch-investment-strategy-q-a?s_tnt=120266:2:0&adobe_mc_ref=https%3A%2F%2Fwww.google.com%2F

[7] Ibid.

[8] “Bank of America declares ‘the end of the 60-40’ standard portfolio”, MarketWatch, Chris Matthews, October 19, 2019, https://www.marketwatch.com/story/bank-of-america-declares-the-end-of-the-60-40-standard-portfolio-2019-10-15

[9] “Bonds aren’t doing their job for investors, the Rorschach Economy, and investment return killers”, Globe and Mail, October 16, 2019, https://www.theglobeandmail.com/investing/investment-ideas/article-bonds-arent-doing-their-job-for-investors-the-rorschach-economy-and/

[10] “Bank Of America Says 60-40 Portfolios Are Dead, They’re Right”, Forbes, Rob Isbitts, October 18, 2019, https://www.forbes.com/sites/robisbitts2/2019/10/18/bank-of-america-says-60-40-portfolios-are-dead-theyre-right/#51c29c2e3991

[11] “Bleak decade ahead for stock and bond returns, warns Morgan Stanley”, MarketWatch, Barbara Kollmeyer, November 4, 2019, https://www.marketwatch.com/story/bleak-decade-ahead-for-stock-and-bond-returns-warns-morgan-stanley-2019-11-04

[12][12] “Don’t celebrate the Dow record too much, Morgan Stanley predicts dismal returns the next decade”, CNBC, Fred Imbert, November 4, 2019, https://www.cnbc.com/2019/11/04/morgan-stanley-markets-will-have-some-low-in-the-next-decade.html

[13] “Bleak decade ahead for stock and bond returns, warns Morgan Stanley”, MarketWatch, Barbara Kollmeyer, November 4, 2019, https://www.marketwatch.com/story/bleak-decade-ahead-for-stock-and-bond-returns-warns-morgan-stanley-2019-11-04

[14] Ibid.

[15] “Billionaire investor Howard Marks warns of ‘dark’ impact of trade war”, David Scutt, Sydney Morning Herald, August 15, 2019, https://www.smh.com.au/business/markets/billionaire-investor-howard-marks-warns-of-dark-impact-of-trade-war-20190813-p52gm1.html

[16] Alan Watts: The Story of the Chinese Farmer, https://wellsbaum.blog/alan-watts-story-of-the-chinese-farmer/

[17] “No Sale: Don’t buy in to ‘the end’ of 60/40 investing”, Chuck Jaffe, The Seattle Times, October 19, 2019, https://www.seattletimes.com/business/no-sale-dont-buy-in-to-the-end-of-60-40-investing/