We hope that this letter finds you healthy and in good spirits. These are trying times for everyone. It doesn’t help our collective psyche that the coronavirus pandemic precipitated a market crash in the order of a ~ 35% drop on the S&P 500. It is not much of a salve to investors, but we note that market declines of 30%+ happen with some regularity – typically, once per decade or so on average. The recent sell-off is yet another reminder that anything can happen in markets – even the “unknown unknowns”; things that we hadn’t even contemplated.

As we write, there is light at the end of the tunnel, however. Economies are slowly being re-opened and there are signs that the pandemic may be brought to heel. It is these optimistic signs that have ignited a huge rally in stocks.

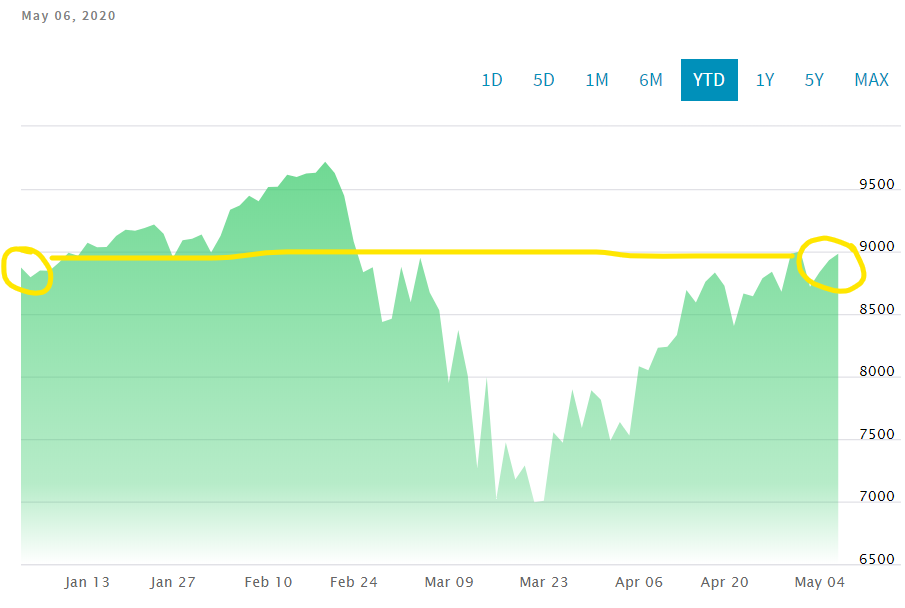

To the surprise of many, the S&P 500 has regained much of the ground lost in the sell-off / panic that occurred in late March. What a roller coaster ride. This “V” shaped recovery (so far!) does not come as much of a surprise to us. Why? Because the shut-down of our economy was voluntary. There was no underlying problem in the economy prior to the Government-mandated closure of the economy such as there was prior to the Financial Crisis in 2008-2009. Warren Buffett used the following analogy at the Berkshire Hathaway Annual Meeting held on May 2, 2020: “In 2008 and 2009 our economic train went off the tracks……This time we just pulled the train of the tracks and put it on a siding[1]”.

It appears that the market is anticipating that the economy will reopen in relatively short order and that a deep, prolonged recession may be averted. Despite this optimism on the part of stock investors no one knows how quickly the economy will recover to pre-pandemic levels of employment and output when the “switch” is flipped back on.

There are a very wide range of outcomes with respect to the pandemic and the path to recovery of our economies. Howard Marks spoke about this unprecedented uncertainty in two recent client memos titled, “Calibrating” and “Knowledge of the Future”. Marks explains that there are two camps with respect to how the epidemic (and economic impact) will unfold – the pessimists and the optimists – and both camps are guessing based on their innate biases[2]. In his words, “These days everyone has the same data regarding the present and the same ignorance regarding the future[3]”.

He quotes the psychologist David Dunning to remind us that, “we may not be able to know the future, but that doesn’t keep us from reaching conclusions about it and holding them firmly[4]”.

Dunning explains that our minds are “filled with the clutter of irrelevant or misleading life experiences, theories, facts, intuitions, strategies, algorithms, heuristics, metaphors, and hunches that regrettably have the look and feel of useful and accurate knowledge. This clutter is an unfortunate by-product of one of our greatest strengths as a species. We are unbridled pattern recognizers and profligate theorizers[5]”.

The very wise Marks knows what he doesn’t know. He recognizes that the path of the economy and the market are very uncertain, particularly at this time when we can’t even rely on past analogies.

Over the month of April, perhaps prematurely, market sentiment quickly switched from fear of losing money to fear of missing out. The “pendulum of investor psychology” swung back from an extreme. You may recall from previous letters that Marks uses the metaphor of a clock pendulum to characterize investor behaviour. As he explains it[6]:

“…..the psychology of the investing herd moves in a regular pendulum-like pattern – from optimism to pessimism; from credulousness to skepticism; from fear of missing opportunity to fear of losing money; and thus from eagerness to buy to urgency to sell. The swing of the pendulum causes the herd to buy at high prices and sell at low prices”.

Ben Carlson, portfolio manager and author of the “Wealth of Common Sense” blog, recently noted how quickly the market reversed. He observes that “there wasn’t really time to wait for the fat pitch”[7]. Carlson, like many of us, laments that the very short time between when it was too early and when it was too late to make opportune investments.

Today, the situation looks uncomfortable in that prices have rebounded (see chart below which shows that the Nasdaq 100 has regained all the ground lost in 2020[8]) while the economic picture looks uncertain and somewhat dire. The title of his blog sums up the situation nicely, “What Happens When Distressed Markets Don’t Give You Distressed Prices?”

Those who consult with charts will tell you that after a big plunge in the stock market, an ensuing rally is not often the final chapter. We place very little stock in charts (technical analysis, in industry jargon) but if history is any guide, we could very well experience another air pocket. After the quickest bear market in history followed by the best month for the S&P 500 since 1974, we may see another rather uncomfortable decline.

A note about charts: historical patterns are interesting information, but they do not inform our investment decision-making. The market tends to overshoot, so the “chartists” are not entirely wrong. Technical analysis is not just reading tea leaves. You often do witness recurring patterns in stock and index trading but that is far from saying that you can reliably profit from these observations.

What might cause another “leg down”? Nobody knows but is interesting to note that the U.S. has an alarming rate of unemployment and the market has roared back close to the highs reached in late 2019. As we write, there are signals coming from Washington of renewed trade tension with China. The timing of this heightened friction is quite unfortunate.

What about all the businesses that may not have enough liquidity to withstand the extreme and hereto for unthinkable scenario of a full business interruption of several months’ duration? Few companies prepared for the apocalyptic scenario that we have been visited upon. What is the ripple effect to households and the economy of the many small businesses that will greatly suffer and may not survive? And what about the effect of all the stimulus spending by Governments – is it free money? Is this a cost that has been kicked down the road? Can Western Governments simply “expand their balance sheet” (i.e. purchase bonds and other securities) every time the economy experiences a shock?

During the Financial Crisis in 2008/2009, the U.S. Federal Reserve Bank purchased Treasurys and mortgage-backed securities. This time, however, the Fed extended its operations to lend to businesses large and small, bought money market funds and municipal bonds, and began buying high-yield corporate debt. At the 2020 Berkshire Hathaway Annual Meeting, Warren Buffett expressed worry about the possible “extreme consequences” of these extraordinary measures[9].

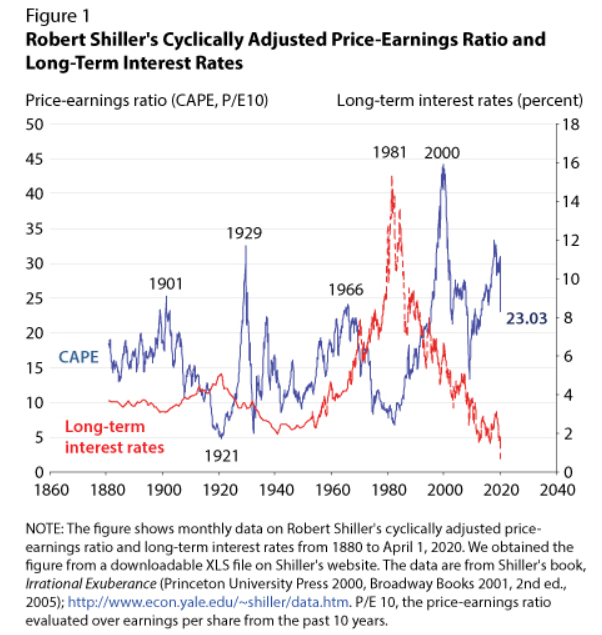

So, we might not be out of the woods yet. So, why the optimism on the part of the stock investors? The answer, in part, is that interest rates remain at extreme lows. This notion that low interest rates justify high stock valuations is not new – it has been widely talked about for several years. Refer to figure 1[10] below. Historically, there has been an inverse relationship (roughly) between interest rates and stock valuations (here, the chart uses the “CAPE” ratio as a measure of valuation).

Investors, generally, require or target returns well above the near-zero yields on fixed income securities. It is true that, over most time periods, bonds (GIC’s) can buffer the risk of your portfolio, but nevertheless, investors are fatigued (understandably) with unacceptable returns on fixed income alternatives. To many, stocks remain the only game in town. Never say never, but it looks unlikely to us that interest rates will be going up anytime soon.

Despite the vicious bear market, the “culture of equities” appears to be alive and well. Our guess is that stocks may not be depressed for long. We would not be surprised if stock valuations were to remain lofty for the foreseeable future, but we acknowledge that we have no special insight on the future.

As we have noted in previous letters (and, as is illustrated in Figure 1), the average P/E (a measure of stock valuation) on the S&P 500 has been much higher over the past 20-25 years than the long-term historical average over prior periods. Why is that? Surely, declining interest rates play a role but another factor, in our view, is that people have figured out that stocks, at least in the long run, are a better bet than competing alternatives. Maybe, the market has grown up.

Said differently, stocks may have been underpriced in prior periods. This was an argument made popular in the late 1990’s by James Glassman and Kevin Hassett, authors of “Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market”. In their book, published in 1999 (exceptionally bad timing), Glassman and Hassett argued that stocks ought to be priced higher than their long-term historical average. They reasoned that over 20-year periods (not an unreasonable investment horizon for most), stocks had never lost money in a real (i.e. after inflation) sense. Bonds (or GIC’s), considered to be “safer”, had experienced negative “real” returns on several occasions over the same period. The authors argued that the “equity risk premium” (the extra return delivered by stocks as compensation for the perceived higher level of risk) was too high.

“Could it be that investors are finally recognizing that stocks and bonds are equally risky and are-quite rationally-bidding up the prices of stocks to levels which make more sense?[11]” they wrote.

Glassman and Hassett’s book was controversial and not particularly well-received by detractors from industry and academia. It was seen as “new-paradigm” thinking and overly bullish. The rationale of the book may have been flawed, at least in part, but the thought bubble that Glassman and Hassett introduced may have been prescient and worthy of consideration. It is noteworthy that stock valuations have been persistently higher since the mid-1990’s. It would appear that the equity risk premium may have shrunk. This is a theory, of course. Nobody knows if this is a permanent or transitory change. Like Dunning said, our minds are filled with much clutter that has the look and feel of knowledge. Having this awareness can give you a healthy degree of skepticism about what you “know” or believe to be true.

But much rides on how we think about the observation that valuations have been persistently higher for the past few decades. Those who will insist on a bargain price relative to historical metrics may very well be out of the market for a long time – perhaps the entirety of their investment time horizon, be it 20, 30 years or more. The opportunity cost of not being invested in stocks for a long period of time is a risk that cannot be ignored. It is for this reason that we are always invested in stocks, in some proportion.

Howard Marks believes, as do we, that the most important decision that you make in investing is not the decision on how much to allocate between stocks and bonds but rather, your positioning with respect to offence and defence, or aggressiveness vs defensiveness[12]. As Marks explains, investors face the twin risks of losing money and missing out on opportunity. We are constantly trying to balance these risks.

The recent market volatility reminds us that the equity risk premium, however large it ought to be, is not free. To earn this premium over “safer” investments, investors must tolerate and have the fortitude to ride out events like a 35% market correction and possibly, a prolonged bear market. But you have all seen the charts about market history. You know, the ones that show previous bear markets and market corrections that are associated with significant events like the “Tech Wreck”, the “Financial Crisis”, the “Russian Ruble collapse”, the “Lost Decade”, “Black Monday”, the “Trade War with China”, etc., etc. Many investors, we think, are becoming inured to these panics. The lesson of market history is that buying into panics, or simply staying invested, has worked over the long haul. Black Monday (1987) is hardly perceptible on a long-term chart of the trajectory of the S&P 500.

Each time that we experience a panic or crisis, it is hard to look beyond the negative headlines and be assured that “this too shall pass”. So, we close with some positive thoughts from Matt Ridley, author of The Rational Optimist:

“Let nobody tell you that the second decade of the 21st century has been a bad time. We are living through the greatest improvement in human living standards in history. Extreme poverty has fallen below 10 per cent of the world’s population for the first time. It was 60 per cent when I was born. Global inequality has been plunging as Africa and Asia experience faster economic growth than Europe and North America; child mortality has fallen to record low levels; famine virtually went extinct; malaria, polio and heart disease are all in decline.

Little of this made the news, because good news is no news. But I’ve been watching it all closely. Ever since I wrote The Rational Optimist in 2010, I’ve been faced with ‘what about…’ questions: what about the great recession, the euro crisis, Syria, Ukraine, Donald Trump? How can I possibly say that things are getting better, given all that? The answer is: because bad things happen while the world still gets better [13]”.

We are going to end on this positive note as we want to get this memo out to you before conditions change and we are forced to revise the content. Truly, “great” can be the enemy of “good”! We hope you all remain healthy and we look forward to seeing you in person when we can reunite!

Best wishes to you and your family from your Apex team: Shawn, Scott, Mike, John, Will, Denise E., Paul, Tina, Jason, Denise N., Lisa, Marta, Darlene and Sharon.

Disclaimer:

The information contained herein was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any securities mentioned. The views expressed are those of the author and not necessarily those of ACPI.

Aligned Capital Partners Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

[1] “Warren Buffett says the economy will overcome coronavirus: ‘Nothing can basically stop America’”, Fred Imbert, CNBC, May 2, 2020, https://www.cnbc.com/2020/05/02/warren-buffett-says-the-economy-will-overcome-coronavirus-nothing-can-basically-stop-america.html

[2] Calibrating, Howard Marks, Oaktree Capital, April 6, 2020, https://www.oaktreecapital.com/insights/howard-marks-memos

[3] Ibid.

[4] Knowledge of the Future, Howard Marks, Oaktree Capital, April 16, 2020, https://www.oaktreecapital.com/insights/howard-marks-memos

[5] Knowledge of the Future, Howard Marks, Oaktree Capital, April 16, 2020, https://www.oaktreecapital.com/insights/howard-marks-memos

[6]The Most Important Thing Illuminated, Howard Marks, 2013.

[7] “What Happens When Distressed Markets Don’t Give You Distressed Prices?”, Ben Carlson, A Wealth of Common Sense, May 6, 2020, https://awealthofcommonsense.com/2020/05/what-happens-when-distressed-markets-dont-give-you-distressed-prices/

[8] Nasdaq, May 6, 2020, https://www.nasdaq.com/market-activity/index/ndx

[9] “Buffett cautions on ‘extreme consequences’ from the Fed’s recent moves”, Jeff Cox, CNBC, May 4, 2020, https://www.cnbc.com/2020/05/04/buffett-cautions-on-extreme-consequences-from-the-feds-recent-moves.html

[10] “The Stock Market’s Wild Ride”, Bruce Mizrach and Christopher J. Neely, Federal Reserve Bank of St. Louis, https://research.stlouisfed.org/publications/economic-synopses/2020/04/10/the-stock-markets-wild-ride

[11] “Mr. Dow 36,000 radically changes his thinking”, Howard Gold, Globe and Mail, March 10, 2011, https://www.theglobeandmail.com/globe-investor/investment-ideas/mr-dow-36000-radically-changes-his-thinking/article571164/

[12] “Calibrating”, Howard Marks, Oaktree Capital, April 6, 2020, “https://www.oaktreecapital.com/docs/default-source/memos/calibrating.pdf?sfvrsn=6

[13] “We’ve Just Had the Best Decade in Human History. Seriously.”, Matt Ridley, Rational Optimist, December 19, 2019, http://www.rationaloptimist.com/blog/best-decade-in-history/