We hope you are keeping well. Since our last correspondence broad Canadian and U.S. stock indices have declined, or corrected [a “correction” denotes a decline of 10%-20%]. While 2022 began with the S&P 500 at an all-time high, it had plummeted close to 20% through May 18[1]. The NASDAQ 100 Index, with a heavy weighting in technology stocks, has declined ~ 30% from its 52-week high[2]. What’s more, we have witnessed a rare decline in the value of both stocks and fixed income investments as interest rates have moved higher.

To us these declines are not surprising nor are they unusual. Stocks routinely correct and occasionally they experience a sharp and more painful rout (think: 2008-2009). As Peter Lynch explained in a 1995 article published by Worth magazine, “Stocks have declined 10 percent or more on 53 occasions since the turn of the century. That’s roughly one correction occurring every two years. And on 15 of these 53 occasions, stocks have declined 25 percent or more. That’s one nasty correction (also known as a bear market) every six years[3]”.

A more current account is as follows: “Since World War II, there have been nine declines of 20% to 40% in the S&P 500, and three others of more than 40% (excluding 2022), according to Guggenheim Investments[4]”.

The “macro” (i.e. related to the broad economy) worries that are cited in the media including inflation, the price of oil and the prospect of recession are factors contributing to recent declines, but as we have pointed out in prior communication, stocks generally, (and certain frothy pockets in particular), had looked overpriced in our estimation. Many popular U.S. stocks had the appearance of a bubble looking for a pin. And it was obvious to most that near-zero yields on fixed income securities were unlikely to deliver a positive real (i.e. after inflation) return.

Recall that, prior to recent declines, the mood of the market and valuations had become exuberant. Following is one observer’s characterization of the mood of the stock market in December, 2021:

“…we’re at a point in the business cycle when the disc jockey is playing Shout by the Isley Brothers and investors can’t stop dancing. We’re in a highly speculative, risk-complacent market driven by a combination of near-zero interest rates, abundant capital and a healthy dose of hype[5]”.

Many small cap market darlings, seen as “disruptors” and worthy of huge valuations in 2021 despite little-to-no earnings, have been pummeled. It will be a long road back for those that ultimately recover.

Jeremy Grantham, chief investment strategist of Grantham, Mayo, & van Otterloo (GMO) wrote about his bearish views of U.S. stocks in January, 2022 describing the market as being in a “vampire phase”:

“…we are in what I think of as the vampire phase of the bull market, where you throw everything you have at it: you stab it with Covid, you shoot it with the end of QE [quantitative easing] and the promise of higher rates, and you poison it with unexpected inflation – which has always killed P/E ratios before, but quite uniquely, not this time yet – and still the creature flies. (Just as it staggered through the second half of 2007 as its mortgage and other financial wounds increased one by one.) Until, just as you’re beginning to think the thing is completely immortal, it finally, and perhaps a little anticlimactically, keels over and dies[6]”.

To some extent, recent declines can be attributed to a sea change in investor sentiment. Markets are comprised of individual participants who, at times, think and behave in herd-like fashion and whose emotions can be mercurial. In markets, Homo Economicus, or “rational man” is a mythical creature. You might think that the price of assets like stocks is based on fundamentals (earnings, asset values and the like) but this is not always so – often, prices are affected by how people think about the outlook for these fundamentals. As Howard Marks explained in a recent note to investors:

“Volatility is the norm. the S&P 500 has returned just over 10% a year on average over the 65 years since it assumed its present form in 1957 [yet]…Its annual return has been between 8% and 12% just six times during this period [emphasis, ours]. Why is it so far from the mean 90% of the time? After pondering this question for a while, I landed on what I consider the explanation: excesses and corrections……that’s what cycles are about, in my opinion. Where do the excesses come from? Psychology. People get too optimistic, then they get too pessimistic. They get too greedy, then they get too fearful. They become too credulous, then they become too skeptical, and so forth. Oh, and the big one: they become too risk-tolerant, and then they become too risk-averse.”

All of the bad economic news that is reported to you in today’s media has weighed on markets but to some extent declines are owing to a change, or inflection point in investor psychology. Credulity, optimism and complacency have been replaced by uncertainty, skepticism and risk aversion.

To be sure, there is a confluence of negative events and worries that lead many to have a bearish view. A widespread concern is that a recession is looming (or has already arrived). There certainly are indicators of a business contraction. Everywhere we look we see plans by corporations to slow the pace of hiring; banks have become more cautious lenders.

JPMorgan Chase CEO Jamie Dimon summed up these concerns in comments related to the bank’s 2022 Q2 earnings, “The U.S. economy continues to grow and both the job market and consumer spending, and their ability to spend, remain healthy. But geopolitical tension, high inflation, waning consumer confidence, the uncertainty about how high rates have to go and the never-before-seen quantitative tightening and their effects on global liquidity, combined with the war in Ukraine and its harmful effect on global energy and food prices are very likely to have negative consequences on the global economy sometime down the road[7]”. Dimon had recently warned investors of a potential economic “hurricane”[8].

These concerns are legitimate and may very well lead to further declines in stock prices. The likelihood of a recession is certainly elevated (but still, not a certainty) given persistently high inflation. Central banks, with the intent of reigning in inflation, may create tight monetary conditions that, in turn, may lead to a recession. Inflation often does precipitate a recession, and recessions are typically accompanied by bear markets in stocks. [the term “bear market” represents a market that has taken a pause and likely derives from the hibernation pattern of bears].

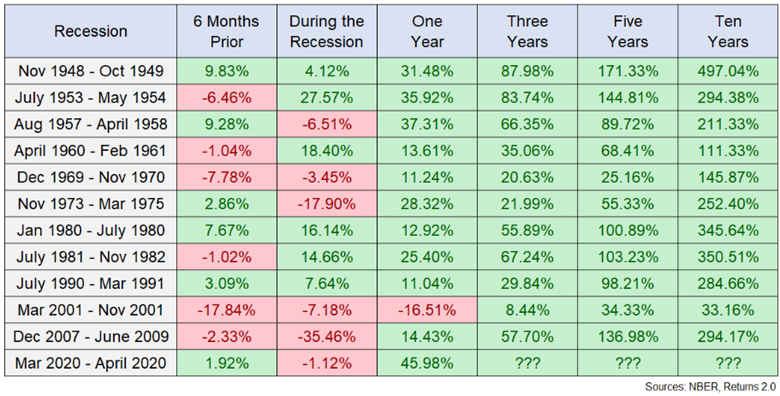

But worrying economic indicators may not necessarily portend further stock declines. Recessions and stock market corrections are not the same thing and they do not always happen in lockstep. Following is an analysis of S&P 500 returns before, during and after each of the past 12 U.S. recessions courtesy of Ben Carlson of Ritholz Wealth Management:

Table shows every recession since WWII along with S&P 500 returns in the 6 months leading up to the recession, during the actual recession itself and then one, three, five years and ten years from the end of the recession[9]:

In reference to this table, Carlson notes that:

Sometimes the stock market front runs the economy. Sometimes the stock market is too slow to react to economic data. Sometimes stocks fall as the economy is contracting. Sometimes stocks bottom well before the economy does. Most of the time, the stock market does very well after a recession is over.

So it follows that:

(1) Predicting the timing of a recession is hard to do.

(2) Predicting how and when the stock market will react to a recession is also hard to do.

Carlson concludes that “You could nail the timing of the recession but completely whiff on the bottom of the stock market. Timing the economy is hard. Timing the stock market is harder.”

So, stock prices today may already have “baked in”, to some extent, the prospect of a recession. As Bill Miller explained in his latest memo to investors, “the market sniffs out economic troubles and adjusts pricing before any “expert” does[10]”.

We are mindful of today’s worrying economic and geopolitical backdrop, but it doesn’t inform our decision-making to a significant extent. The great investor Seth Klarman sums up our thinking in saying “We worry top-down, but we invest bottom-up”. Investing “bottom-up” refers to the strategy of, simply put, buying good companies at good prices. After all, stocks are nothing more than a fractional interest in a company. The bottom-up investor accepts that many things are unknowable or not reliably predictable.

It sounds almost too simple to state that what works in investing is to find good businesses with strong competitive advantages, buy them when the price is fair-to-good, and then sit on your hands and do nothing. But that is precisely what we advocate and practise.

It is difficult to hold your stocks through periods of adversity when negative news and gloomy forecasts abound. It is times like these when people tend to get shaken out of their stocks. In the field of investing, patience, optimism and the ability to hang on through thick and thin are superpowers. It has been said that the stock market is rigged in favour of the patient investor.

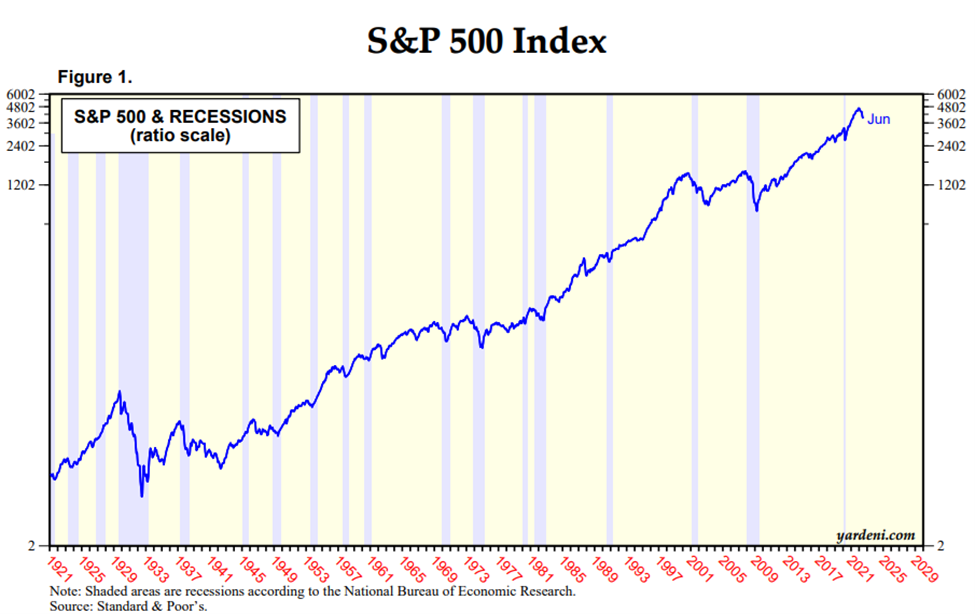

The economy occasionally contracts, stocks routinely correct, investor psychology swings from one extreme to another, yet indices such as the S&P 500 have continued to march ever higher despite these setbacks (see long-term historical record of S&P 500 price index below courtesy of Yardeni Research Inc. Shaded bars are recessions.[11]):

Generally speaking, owning a broad basket of large U.S. companies over longer time periods (say, 5-10+ years) is a “positive-sum game”, as Warren Buffett explained in his 2020 Chairman’s Letter:

“Ownership of stocks is very much a “positive sum” game. Indeed, a patient and level-headed monkey, who constructs a portfolio by throwing 50 darts at a board listing all of the S&P 500, will – over time – enjoy dividends and capital gains, just as long as it never gets tempted to make changes in its original “selections [emphasis, ours].[12]”

A positive-sum game means that total gains and losses are greater than zero – resources are increased.

Generalizing, stocks represent businesses, which distribute some of their earnings (dividends) and reinvest some of their earnings for potential growth and capital gains. Patient investors in stocks earn the returns generated by the underlying businesses, whereas trading in and out of stocks can be a zero-sum game (in order for you to win, someone else must lose). If you wait at a bus stop you will eventually catch a bus, but if you impatiently move from one stop to another, you may never catch a bus.

The patient, level-headed monkey can potentially beat the highly intelligent investor with an ill-suited temperament.

Macro worries are omnipresent (today’s worries will be replaced by a new slate of worries tomorrow). It is often a mistake to react to them. When faced with declining values of our investments, our intuition might be to take action. It may seem counter-intuitive but it is often better to do nothing than to try and be clever. In a 2011 article for Forbes magazine Columbia Business School Professor Michael Mauboussin explained that, “The American ethic, or probably Western ethic, is that hard work equates to better outcomes. That’s not always true in the world of investing.[13]“

You may remember 2011 as a period of turmoil in U.S. stocks. The worries that were top of mind for investors in 2011 were plentiful including a European debt crisis, recession worries, and a first-ever downgrade to the credit rating of the U.S. Government. U.S. stocks dropped 19.4% in the fall of 2011[14]. Conditions then, were similar to today. At that time, the late and great John Bogle offered this advice: “Simply put: Simply stay put. My rule — and it’s good only about 99% of the time, so I have to be careful here — when these crises come along, the best rule you can possible follow is “Don’t just do something, stand there![15]“

In hindsight we can observe that “staying put” proved to be good advice. The ensuing decade saw the S&P 500 increase from ~ 1100[16] (2011 trough) to ~ 4000 today.

Today’s headline news about the economy and stocks may be discomforting and we may yet see further declines but this too shall pass.

We hope you are enjoying the summer weather. As always, give us a call if you wish to discuss your investments, or maybe just say “hello” and get caught up.

Best wishes to you and your family from your APEX team: Shawn, Mike, Denise N., Lisa, Marta, Denise E., John, Will and Jeannot.

Disclaimer:

This publication is for informational purposes only and has been prepared from public sources which are meant to be reliable. None of the information in this should be construed as investment advice. Speak to your Investment Advisor to learn if this product is right for you. Apex Investment Management is a tradename of Designed Securities Ltd. DSL is regulated by the Investment Industry Regulatory Organization of Canada and a Member of the Canadian Investor Protection Fund . The views expressed are those of the author and not necessarily those of DSL.

[1] “S&P 500 falls again on Thursday, inching closer to bear market territory”, Sarah Min, CNBC, May 18, 2022, https://www.cnbc.com/2022/05/18/stock-market-futures-open-to-close-news.html

[2] Stock Market News for May 23, 2022, Zacks Equity Research, May 23, 2022, https://www.nasdaq.com/articles/stock-market-news-for-may-23-2022

[3] “Fear of Crashing”, Peter Lynch and John Rothchild, Worth, September 1995, https://www.worth.com/from-the-archives-fear-of-crashing/

[4] “What to know as S&P 500 enters bear market territory: ‘The bottom line is, it’s a tough time,’ says financial advisor”, Greg Iacurci, CNBC, June 14, 2022, https://www.cnbc.com/2022/06/14/the-sp-500-closed-in-a-bear-market-on-monday-what-does-that-mean.html

[5] “It’s hard not to dance when everyone else is having a great time, but investors beware”, Tom Bradley, Financial Post, December 17, 2021, https://financialpost.com/investing/investing-pro/its-hard-not-to-dance-when-everyone-else-is-having-a-great-time-but-investors-beware

[6] “LET THE WILD RUMPUS BEGIN”, Jeremy Grantham, GMO LLC, January 20, 2022, https://www.gmo.com/globalassets/articles/viewpoints/2022/gmo_let-the-wild-rumpus-begin_1-22.pdf

[7] “JPMorgan Chase earnings fell 28% after building reserves for bad loans, bank suspends buybacks”, Hugh Son, CNBC, July 14, 2022, https://www.cnbc.com/2022/07/14/jpmorgan-jpm-2q-2022-earnings.html

[8] “Jamie Dimon Changes Tone on Economy, Saying He Now Sees a Hurricane”, Carleton English, Barron’s, June 1, 2022, https://www.barrons.com/articles/jamie-dimon-economy-hurricane-jpmorgan-51654105015?mod=Searchresults&mod=article_inline

[9] “Timing a Recession vs. Timing the Stock Market”, Ben Carlson, A Wealth of Common Sense, June 6, 2022, https://awealthofcommonsense.com/2022/06/timing-a-recession-vs-timing-the-stock-market/

[10] “Trading Perceived Stability for Underappreciated Stability as the Cost of Uncertainty Rises”, Bill Miller, Miller Value Partners LLC, July 20, 2022, https://millervalue.com/trading-perceived-stability-for-underappreciated-stability-as-the-cost-of-uncertainty-rises/

[11] “Stock Market Indicators: S&P 500 Recession Cycles”, Edward Yardeni and Joe Abbott, Yardeni Research Inc., June 30, 2022, https://www.yardeni.com/pub/stmktsp500recess.pdf

[12] https://www.berkshirehathaway.com/letters/2020ltr.pdf

[13] “Bogle To Investors: ‘Don’t Do Something, Stand There!’”, Chris Barth, Forbes, August 9, 2011, https://www.forbes.com/sites/chrisbarth/2011/08/09/bogle-to-investors-dont-do-something-stand-there/?sh=4c5b1fbe2b47

[14] S&P 500 Bull & Bear Market Tables, Yardeni Research Inc., June 2022, https://www.yardeni.com/pub/sp500corrbeartables.pdf

[15] Ibid.

[16] Ibid.