Dear friends,

We hope this letter finds you well. It is a new year, so we write to give our thoughts on two topics: the stock market and interest rates.

As you are aware, fixed income investments (i.e. those that pay a fixed rate of interest and promise to return your principal at a future date) have been unattractive (for savers and investors, that is) for several years. In the wake of the Great Financial Crisis (2009), we saw a decade of near-zero interest rates. In 2022, central banks began aggressively hiking short-term interest rates in response to a spike in inflation. Today, the consensus view is that inflation has been tamed and we can look forward to interest rate easing in 2024, or perhaps 2025.

Howard Marks of Oaktree Capital LLC summed up the consensus view in a January 9, 2024, note[1] to investors:

The consensus is as follows:

- Inflation is moving in the right direction and will soon reach the Fed’s target of roughly 2%.

- As a consequence, additional rate increases won’t be necessary.

- As a further consequence, we’ll have a soft landing marked by a minor recession or none at all.

- Thus, the Fed will be able to take rates back down.

- This will be good for the economy and the stock market.

Marks says that this consensus “smacks of goldilocks thinking[2]”. We share his skepticism due in part to the dismal record of prediction in such things.

As an illustration of the folly of prediction, take a moment to reflect on the U.S. Fed’s outlook at the beginning of 2021:

February 2021 – Jerome Powell states: “I really do not expect that we’ll be in a situation where inflation rises to troubling levels[3].”

December 2021 – The Fed forecasted that it would need to raise rates three times and that its policy target rate would end in 2022 between 0.75 per cent and one per cent[4]. What happened? The Fed raised the Fed funds rate seven times in 2022, ending the year with a target rate at 4.25-4.50%. Today, it is 5.5%.

In short, the Fed doesn’t even know what the Fed will do.

The path of future interest rates, while quite unpredictable, is important to investors because it affects, well, just about everything including the economy and the price of assets such as stocks and real estate. As well, it affects investors decision-making – as yields increase, investors are less inclined to buy riskier assets.

We have great humility about our ability to predict the future path of interest rates, but we do invest with an awareness of today’s environment. Marks agrees: “at Oaktree, we say it’s okay to have opinions on the macro; it’s just not okay to bet clients’ money on them…..our investment decisions are always based on bottom-up analysis of companies and securities, not macro forecasts[5]”.

Here is Marks recent commentary on the “macro”[6]:

“The one I’m asked most often these days: ‘Are you saying interest rates are going to be higher for longer?’ ‘My answer is that today’s rates aren’t high. They’re higher than we’ve seen in 20 years, but they’re not high in the absolute or relative to history. Rather, I consider them normal’”.

He adds that, “We’re unlikely to go back to such easy money conditions, other than temporarily in response to recessions” and, “….the investment environment in the coming years will feature higher interest rates than those we saw in 2009-21[7]”.

Instead of trying to invest based on prediction or a “macro” view, generally a losing proposition, we simply look at what is on offer today, in terms of risk and return. Our strategy over the recent period of ultra-low interest rates (2009-2021), was based on a such an observation: the potential returns (i.e. yields) on longer-term fixed income investments, were inadequate for the inherent risk (i.e. inflation and the likely normalizing of interest rates).

Similarly, rather than try to predict what the stock market will do, we simply try to find good companies at good prices. Which brings us to our next topic: stocks.

Those of you who have been clients for some time will know our philosophy about investing in stocks. It is best characterized as “quality” investing. Below, we share our thoughts on the merits of this strategy.

We don’t invest based on “macro” predictions about the near-term trajectory of the stock market. Rather, we simply look to buy quality companies at good prices. It must be said that “quality” is a subjective term. In our view, “quality” companies possess the all-important characteristic of “moat”, or competitive advantage.

Rather than invest in the new thing (nascent industries or companies that are popular and widely believed to have great long run potential), we like companies that have already won – those that are quite likely (in our estimation) to not only survive but to thrive. Warren Buffett refers to competitive advantage as “moat”. In his words, “Capitalism is all about somebody coming and trying to take the castle … A good business is like a strong castle with a deep moat around it. I want sharks in the moat. I want it untouchable[8].”

Companies that possess moat, typically are highly profitable and earn high returns on capital. They have excess money left in the till, which they are then able to return to shareholders (the owners), often in increasing amounts; some are swimming in cash. Clearly, these are desirable attributes that every business owner or shareholder would applaud.

Despite the logic of such an approach, many investors are drawn to the “new thing”, owing to the buzz that often surrounds popular stocks. Often, this cohort doesn’t yet possess characteristics of moat.

The problem with investing in the new thing, is that the future, as it relates to new technologies or nascent industries, is not as predictable as you might think. It’s far from easy and it can be perilous. The U.K. fund manager Terry Smith spoke about this in his recent annual letter to Fundsmith investors[9]:

Think back to some of the major technology developments of the past half century or so and the early leaders:

• Microchips: Intel

• Internet Service Providers: A

• Mobile Phones: Nokia

• Search Engines: Yahoo

• Smartphones: Research In Motion (Blackberry)

• Social Media: Myspace

Where are they now? Does this experience suggest that we can predict a winner?

With respect to the “new thing”, it is often best to wait and see how the industry will shakeout. Consider that Apple didn’t start making the iPhone until 2007, whereas Nokia and Research in Motion were early pioneers that were once market darlings. It is best to have humility about our ability to pick winners.

Identifying companies that have durable moats requires qualitative judgement. As Buffett points out, “No formula in finance tells you that the moat is 28 feet wide and 16 feet deep. That’s what drives the academics crazy”.

This qualitative analysis includes asking fundamental questions like:

- “How hard would it be for a competitor to take share from this company”?; or

- “What is the likelihood that this particular company will maintain its enviable competitive position for a decade or longer”?; or

- “How important and desirable is the company’s product or service to customers? Are there close substitutes”?

Importantly, companies that have wide moats entail lower business risk (we are generalizing here), relative to no-moat companies, owing to their entrenched market position, pricing power and above-average levels of profitability. “Heads I win, tails I don’t lose much” is a quote often repeated by Buffett and Munger in reference to their focus on moat and the concept of “margin of safety” (i.e. a favourable price works to lessen the risk of an investment proposition).

It is natural to ask, “doesn’t lower risk equate to lower return”? Do you sacrifice return in forgoing the new thing to invest in wide moat quality stocks? These are questions that were posed recently by Ben Inker of Grantham, Mayo (GMO LLC) in a research paper titled, “The Quality Anomaly, The Weirdest Market Inefficiency in the World[10]”. According to Inker:

“The basic goals of any active investor are to achieve higher returns and/or lower risk than a passive portfolio. These goals are, or at least should be, in conflict with each other. If financial markets were efficient, it would be impossible to sustainably achieve higher returns without taking on additional risk. And any portfolio that embodied lower risk would pay for it with lower long-term returns”.

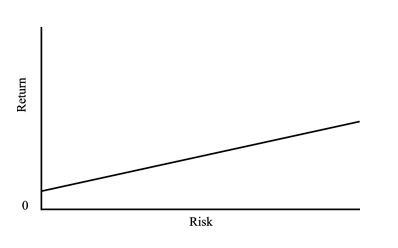

Here, Inker is talking about the simple textbook theory that says you must take on more risk to achieve higher returns (see graph below):

He goes on to explain that this simple theory is generally true, but quality stocks represent an anomaly:

“At the highest level, markets basically work this way. Government bonds and cash are lower risk than high yield bonds and equities and have delivered lower returns across almost all markets and most time periods. But within risk assets, things get weird. Within both stocks and high yield bonds, you have historically been able to achieve both higher returns and lower risk by owning the highest quality securities in those universes”.

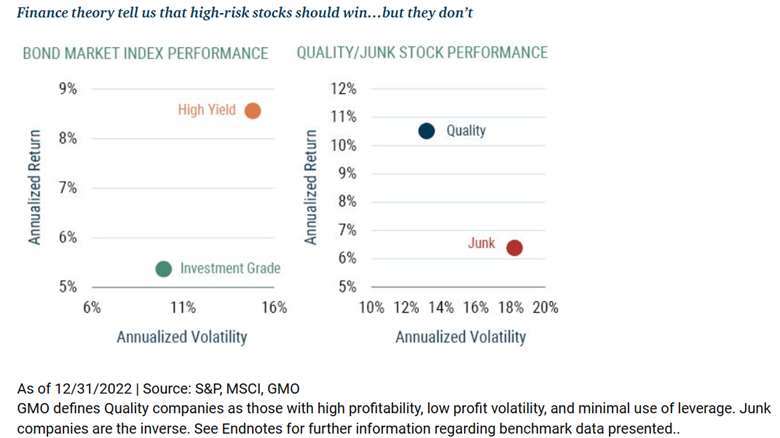

In 2023, Inker’s colleague Tom Hancock also wrote on this “quality anomaly”[11]. His research is summarized by the two graphs below. On the left, we see that high yield bonds do in fact return more than investment grade bonds as the simple theory would suggest (higher risk corresponds with higher return). But within the universe of stocks, we witness an anomaly – higher quality has delivered higher returns with less risk than a cohort of “junk” (i.e. those not exhibiting quality attributes) stocks. In his words,

“In fixed income markets, for example, high yield (junk) bonds have returned more than lower risk investment grade securities. In equity markets, however, higher-quality stocks have outperformed lower-quality (junk) stocks by a considerable margin despite being much less risky (see Exhibit 1)”.

Inker sums it up as, “In an investing world where most trade-offs are difficult, this one is pretty easy. If you were going to have one permanent bias in your equity and high yield bond portfolios, it should be in favor of high quality”.

We can’t say conclusively why the quality anomaly has persisted, but here is one possible explanation: Investors prefer the new thing, bidding up prices of the lower quality cohort. In contrast, wide-moat stocks may be perceived as relatively unexciting – they are often not the market movers that provide instant gratification and social proof. As such, they are underpriced in a relative sense.

The presence of moat is of paramount importance, but you also must consider price and other factors like growth potential (runway) and culture. In our experience, this last criterion is both rare and important. Culture can set a company apart from its peers. What is corporate culture? Culture is hard to define, but “you know it when you see it”, as United States Supreme Court Justice Potter Stewart famously quipped. In our experience, a desirable culture is often found in founder-led, or family-controlled companies – they tend to make decisions in the long-term interests of the business and its owners. Other desirable culture traits include an obsession with controlling costs or serving the customer. Here are a few examples to flesh this out for you:

- Costco: An obsession with keeping costs low for members (even at the expense of margins) and treating employees right.

- Amazon: Also, an obsession with the customer but also a willingness to experiment and fail.

“We see our customers as invited guests to a party, and we are the hosts. It’s our job every day to make every important aspect of the customer experience a little bit better.” – Jeff Bezos

- Berkshire Hathaway: An obsession with controlling costs and patient, conservative investment principles, led by highly intelligent fanatics – who have a lot of skin in the game that didn’t accrue from stock options or awards.

- Apple – a vast, walled ecosystem populated by billions of loyal users. Apple is the world’s most profitable company. Customer surveys continue to confirm the persistence of extreme customer loyalty.

Occasionally, investors can find an opportunity to buy quality stocks that have a desirable culture at a fair or even good price. This trifecta creates a good opportunity to invest, in our view. It requires patience, discipline, and independent thinking.

To sum up, we advocate for a simple approach that is shared by great investors such as Terry Smith: don’t make forecasts, focus on competitively advantaged, or “quality” companies, be careful not to overpay, and then avoid the temptation to tinker. Take it from master investor Warren Buffett:

“All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies”.

Each investor’s circumstances are unique (i.e. risk appetite and capacity for loss, objectives, etc.), but many investors share one psychological trait – they want to go to heaven, but they prefer not to die. No investment strategy is without risk, but quality investing, in our view, is the best approach to balance investors’ desire for growth and dividend income with the risk of investing in stocks.

Best wishes to you and your family from your APEX team: Shawn, Mike, Denise N., Lisa, Marta, Denise E., John, Will and Jeannot.

Disclaimer:

This publication is for informational purposes only and has been prepared from public sources which are meant to be reliable. None of the information in this should be construed as investment advice. Speak to your Investment Advisor to learn if this product is right for you. Apex Investment Management is a tradename of Designed Securities Ltd. DSL is regulated by the Investment Industry Regulatory Organization of Canada and a Member of the Canadian Investor Protection Fund . The views expressed are those of the author and not necessarily those of DSL.

[1] “Easy Money”, Howard Marks, Oaktree Capital Management LLC, January 9, 2024, https://www.oaktreecapital.com/insights/memo/easy-money

[2] Ibid.

[3] “Powell Focuses on Economic Need at Key Moment in Markets and Politics”, Jeanna Smialek, February 2021, New York Times, https://www.nytimes.com/2021/02/23/business/economy/powell-focuses-on-economic-need-at-key-moment-in-markets-and-politics.html

[4] “The majority of Fed members forecast three interest rate hikes in 2022 to fight inflation”, Maggie Fitzgerald, CNBC, December 15, 2021, https://www.cnbc.com/2021/12/15/the-majority-of-fed-members-forecast-three-interest-rate-hikes-in-2022-to-fight-inflation.html

[5] Ibid.

[6] “Easy Money”, Howard Marks, Oaktree Capital Management LLC, January 9, 2024, https://www.oaktreecapital.com/insights/memo/easy-money

[7] Ibid.

[8] “How to find stocks with an ‘economic moat’”, Jason Del Vicario and Steven Chen, The Globe and Mail, November 24, 2023, https://www.theglobeandmail.com/investing/investment-ideas/article-how-to-find-stocks-with-an-economic-moat/

[9] https://www.fundsmith.co.uk/media/31plodnq/2023-fef-annual-letter-to-shareholders.pdf

[10] https://www.gmo.com/globalassets/articles/quarterly-letter/2023/gmo-quarterly-letter_4q-2023.pdf

[11] “THE QUALITY SPECTRUM, Stability in an Unstable World”, May 24, 2023, Tom Hancock, Lucas White, GMO LLC, https://www.gmo.com/americas/research-library/1q-2023-gmo-quarterly-letter_gmoquarterlyletter/?selected_tab_css=lrf-register-tab&Success=27