We hope that this letter finds you well. We had prepared a letter for you at an earlier date but decided to rework the original draft to include commentary on recent events. We had planned to talk about high valuations and downside risk but the coronavirus spread and ensuing stock market panic pre-empted that discussion.

At time of writing, the spread of coronavirus threatens lives around the world and, although a lesser concern than our health, looks increasingly likely to impede economic activity / growth in China and elsewhere. And markets are taking notice. As you know, stock markets, globally, are down as fears grow of a pandemic and possible recession.

At this time, no one seems to have a good understanding of the degree of threat posed by this outbreak, but a recent article by author Ben Carlson included the idea that “when a pandemic occurs, fear tends to spread even faster than the virus itself[1]”.

A comment in a recent Barron’s article sums things up nicely, “No one really knows how the global Covid-19 outbreak will shake out before it’s over, or how deep the negative economic impact will be. Sell now and figure it out later seems to be the mantra[2]”.

We are reminded again that market sentiment can swing from “flawless to hopeless” as Howard Marks has long observed[3]. The market is mercurial and, at times, manic-depressive. The crowd can quickly switch from worrying about missing opportunities to worrying about losing money. Day-to-day market moves reflect investor sentiment which can swing wildly from greed to fear. It is a mistake to impute much intelligence to short-term market gyrations; you just can’t take these swings too seriously.

And there is always something to worry about. In a recent Globe and Mail article, the economist David Rosenberg listed some of the worries that have preoccupied investors in each of the past several years[4]:

2010: Double-dip recession risks

2011: U.S. debt downgrade

2012: Default risk among Europe’s “PIGS” (Portugal, Italy, Greece and Spain)

2013: Markets have a “taper tantrum”

2014: Ebola outbreak

2015: Oil price plunge, energy recession

2016: Chinese currency devaluation, emerging markets turmoil

2017: First year of Trump presidency

2018: Fed overtightens, yield curve inverts

2019: U.S.-China trade war

2020: Coronavirus

“Your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed. It isn’t the head but the stomach that determines the fate of the stock picker [or investor, in general]. The skittish investor, no matter how intelligent, is always susceptible to getting flushed out of the market” – Peter Lynch

As of Wednesday, February 26, the S&P 500 had declined more than 10%[5], however some context is in order. These declines are from the all-time highs reached just very recently and against the backdrop of several years of gains. For example, consider that the S&P 500 returned 28.9% in 2019[6].

Also keep in mind that “corrections” are normal in stocks – they come with the territory. The last time that we experienced a correction was the fourth quarter of 2018 when the S&P 500 dropped ~ 13.9%[7]. What is a correction? It is generally defined as a decline of 10% or more.

Here is some perspective on stock market corrections from a 2018 Forbes article[8]: “…a study conducted before this recent dip of every S&P 500 pullback since 1945 reveals that there were 77 drops of between 5% and 10% and that the average time it took for the market to recover was just one month. In the postwar period, there have been 27 corrections of between 10% and 20%, which have taken an average of four months to reverse. Even the eight bigger crashes, of 20% to 40%, took only 14 months to recover from. And by the way, of those 27 corrections between 10% and 20%, most took place during long bull runs in the market. They’re as common as acne on teenagers”.

In his 2017 Chairman’s Letter to Berkshire Hathaway Shareholders[9], Warren Buffett gave his perspective on market downturns:

“For the last 53 years, [Berkshire] has built value by reinvesting its earnings and letting compound interest work its magic. Year by year, we have moved forward. Yet Berkshire shares have suffered four truly major dips. Here are the gory details:

Period High Low Percentage Decrease

March 1973-January 1975 93 38 (59.1%)

10/2/87-10/27/87 4,250 2,675 (37.1%)

6/19/98-3/10/2000 80,900 41,300 (48.9%)

9/19/08-3/5/09 147,000 72,400 (50.7%)

There is simply no telling how far stocks can fall in a short period….In the next 53 years our shares (and others) will experience declines resembling those in the table. No one can tell you when these will happen. The light can at any time go from green to red without pausing at yellow…..That’s the time to heed these lines from Kipling’s “If”:

“If you can keep your head when all about you are losing theirs . . .

If you can wait and not be tired by waiting . . .

If you can think – and not make thoughts your aim . . .

If you can trust yourself when all men doubt you…

Yours is the Earth and everything that’s in it.”

Contrary to Buffett’s advice, the initial inclination for some is to sell their stocks based on a view that we may be on the cusp of further declines. Shouldn’t investors go to cash (i.e. sell stocks) and wait for an opportunity to get back in at lower prices you might ask? This is often a mistake in our experience. No one rings a bell when the market has bottomed, so your timing is likely to be off such that you underperform, on average, the returns to a simple buy-and-hold strategy.

It is never obvious that initial market declines will accelerate and continue – until after the fact. How do you know if a few bad days are a short-term respite in an ongoing bull market or the beginning of a larger prolonged downturn? This is not at all obvious. And, of course, the crowd has cottoned on to the possibility of an economic slowdown due to the coronavirus spread so the bad news may already be priced into the market. There is no point in closing the barn door after the horse has escaped.

Prior to the past week, the mood of the stock market, generally, had been bullish – in part because the recent experience had been good. As you know, investors’ attitudes about risk are often biased by recent experience. As the saying goes: Humans eat, sleep, and extrapolate. And nowhere has the recent experience been better than in North American technology stocks, particularly the mega-cap stocks like Amazon and Alphabet. Technology stocks are “what has worked”. It is not hard to see why this cohort has fared well – clearly, they have experienced rapid growth and are delighting consumers with highly desirable and convenient / time-saving products and services.

On a more positive note, it is constructive to reflect on how technology and innovation continue to solve the world’s most pressing problems and elevate our standard of living. That message was the topic of a recent Financial Post column, “The future is faster — and better — than ever as tech reinvents the world” by Diane Francis[10]. Francis’ article cites the work of Peter Diamandis, a “serial entrepreneur, medical doctor and aeronautical engineer”. Diamandis is the author of “The Future is Faster than You Think”, a recent book about abundance and the acceleration of technology innovation.

According to Diamondis, “In 1920, we could only find four innovations: the first commercial radio station, the hand-held hairdryer; the Band Aid; and traffic lights. By contrast, last year saw tens of thousands of technological and scientific breakthroughs[11]”.

To Diamandis, “technology is part of ‘a continuous march toward abundance’ to meet the needs of all humanity[12]”.

To give an example of this march toward abundance, here is an excerpt from the same article: “huge savings for people in developed countries, in terms of time and money, occurred with the invention of Google search, iPhones and massive data storage capability. This time and money has been reinvested to execute more of the same types of time and money saving innovations. For instance, the cost of sequencing the genome in 2001 was US$100 million and now it can be done for only US$100. And the value, in 2012 dollars, of all equipment contained in today’s iPhone in 2012 dollars is US$1 million — the cameras for photos and video, storage, facial recognition, telephones, laptops, search and artificial intelligence capability[13]”.

To be sure, technology and innovation are good for humanity and investors alike. But, and you probably guessed this was coming, there is a catch. Here is Howard Marks to explain:

“Tech and venture investors have made a lot of money over the last ten years. Thus there’s great interest in tech companies … and willingness to pay high prices today for the possibility of profits far down the road. There’s nothing wrong with this, as long as the possibility is real, not over-rated and not over-priced[14]”.

The catch, as Marks points out, is to correctly gauge whether the level of optimism about the prospects for stocks is warranted or over-rated. “What has worked” in recent years may not be a good bet for the next decade. And, importantly, as prices increase, so too does risk. Here is Howard Marks to explain:

“As an asset appreciates, causing people to think more highly of it, it becomes riskier. As an asset declines in price, making people view it as riskier, it becomes less risky (all else being equal)[15]”.

You see, investment success doesn’t come from “buying good things,” but rather from “buying things well”, as Marks wisely counselled in his 2011 book, “The Most Important Thing”[16]. “What has worked” and “what is good” may not turn out to be a good investment and may potentially be risky due to the high valuations that often accompany stocks that are popular / highly regarded.

Great investors, like Marks or Buffett, look for mispricing or asymmetry. To them, each investment is evaluated as a wager / proposition, where the potential upside is weighed against the downside risk. They “think in bets”.

We borrowed this phrase from the popular 2018 book, “Thinking in Bets”, by author and professional poker player Annie Duke. We don’t mean to equate investing in stocks with playing roulette, baccarat or other games of chance where the “house” has an edge and the payoff is binary – reward or ruin. To be sure, investing involves skill. But gambling and investing have this in common: they both involve making decisions about an uncertain future. It is a useful mental construct that we employ when evaluating stocks and other potential investments.

The point is that you must pay attention to the downside in every “bet”, particularly when prices are high and risk premiums are low. After all, everybody wants to go to Heaven but nobody wants to die.

The essence of investment management is the management of risks, not the management of returns.

– Benjamin Graham

The very wise U.S. billionaire Sam Zell captured the essence of this idea in his latest book, “Am I Being Too Subtle?”. According to Zell, who clearly knows a good bet when he sees one, “the basics of business are straightforward. It’s largely about risk. If you’ve got a big downside and small upside, run the other way. If you’ve got a big upside and a small downside, do the deal. Always make sure you’re getting paid for the risk you take[17]”.

Marks agrees:

“…in order to achieve superior results, an investor must be able – with some regularity – to find asymmetries: instances when the upside potential exceeds the downside risk. That’s what successful investing is all about[18].”

To the investor who “thinks in bets”, there have been few investment opportunities of late that offer asymmetry (i.e. prospective investments that are perceived to offer greater upside potential than downside risk). In the past few years we have been cautious about buying stocks. In our estimation, valuations on most financial assets, including stocks and bonds in Canada and the U.S. have looked high, and therefore not particularly compelling and somewhat risky. One possible silver lining to the recent correction in stocks is that, in general, the present environment offers a better risk / reward relationship going forward.

A recent article by Michael Batnick, Director of Research at Ritholtz Wealth Management, LLC provides more soothing perspective on the U.S. market[19]:

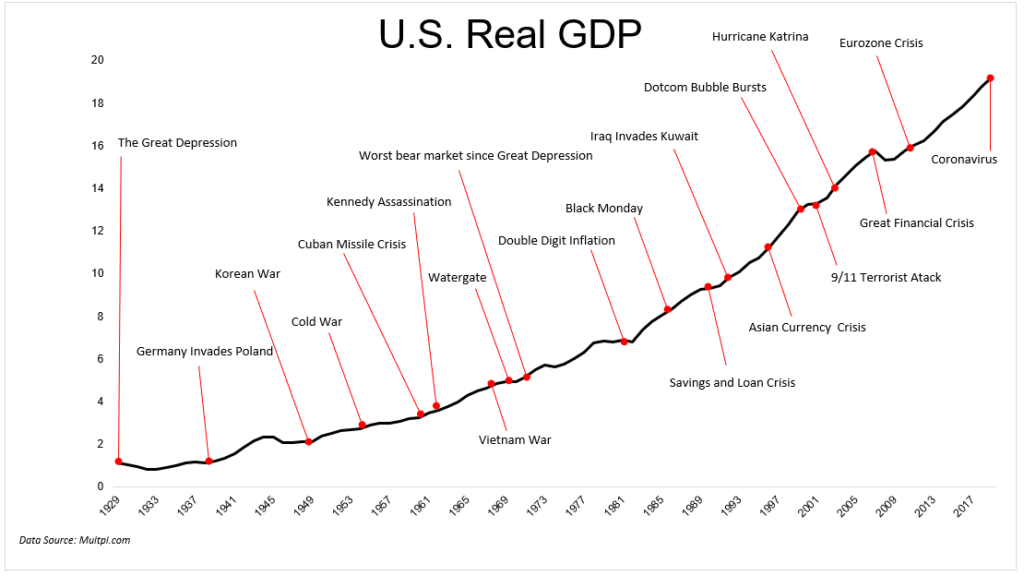

“Stocks generally go up over time. Why? Because stocks are not just numbers on a screen, they represent something very real. Stocks are fractional shares of ownership in a business. Businesses are the life blood of the economy, and the economy is an irrepressible engine of progress.

This country has seen it all: war and peace, inflation and deflation, natural disasters, and financial crises, just to name a few. The chart below shows the growth of real GDP over time. It is a testament to human’s ability to strive for and create a better tomorrow. Very few people have gotten rich by betting against progress”.

Recent market events may be unsettling, but the positive message from Batnick and Diamondis is that the long march toward progress and abundance will not abate and may potentially accelerate.

We leave you with one final message, passed down through the ages. The late (and great) John Bogle for many years quoted, with respect to market disruptions, the Persian adage heaped in timeless wisdom, “This too shall pass”. Here, in his words:

“Your success in investing will depend in part on your character and guts and in part on your ability to realize, at the height of ebullience and the depth of despair alike, that this too, shall pass.” – John Bogle

Best wishes to you and your family from your Apex team: Shawn, Scott, Mike, John, Will, Denise E., Paul, Tina, Jason, Denise N., Lisa, Marta, Darlene and Sharon.

Disclaimer:

The information contained herein was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any securities mentioned. The views expressed are those of the author and not necessarily those of ACPI.

Aligned Capital Partners Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada (www.IIROC.ca).

[1] “Fear and Influenza: How Viruses Spread”, A Wealth of Common Sense, Ben Carlson, February 26, 2020, https://awealthofcommonsense.com/2020/02/fear-and-influenza-how-viruses-spread/

[2] “The Dow Fell 1,191 Points in a Historic Plunge Because of Covid-19”, Barron’s, Nicholas Jasinski, February 27, 2020, https://www.barrons.com/articles/dow-jones-industrial-average-fell-because-of-coronavirus-outbreak-51582840966

[3] “Billionaire investor Howard Marks says investors are ‘not discriminating’ between stocks as market sells off”, Jesse Pound, CNBC, February 24, 2020, https://www.cnbc.com/2020/02/24/billionaire-investor-howard-marks-says-investors-are-not-discriminating-between-stocks-as-market-sells-off.html

[4] “Rosenberg: Investors, let’s contain our bearishness – this too shall pass”, Globe and Mail, David Rosenberg, February 28, 2020, https://www.theglobeandmail.com/investing/markets/inside-the-market/article-rosenberg-investors-lets-contain-our-bearishness-this-too-shall/

[5] “Dow plunges 1,100 points, bringing its decline from a record high to more than 10%”, CNBC, Fred Imbert, February 26, 2020, https://www.cnbc.com/2020/02/26/dow-futures-fall-after-microsoft-issues-coronavirus-warning.html

[6] https://apnews.com/58fdefbcb8bb58c1ddd494ba2f033397

[7]“US stocks post worst year in a decade as the S&P 500 falls more than 6% in 2018”, Fred Imbert, CNBC, December 31, 2018, https://www.cnbc.com/2018/12/31/stock-market-wall-street-stocks-eye-us-china-trade-talks.html

[8] “Sure, It’s A Correction. History Shows They’re A Common Feature Of Bull Markets”, Forbes, K.G. Winans, February 9, 2018, https://www.forbes.com/sites/kennethwinans/2018/02/09/sure-its-a-correction-history-shows-theyre-a-common-feature-of-bull-markets/

[9] Berkshire Hathaway Chairman’s Letter, April, 2019https://www.berkshirehathaway.com/letters/2017ltr.pdf

[10] “Diane Francis: The future is faster — and better — than ever as tech reinvents the world”, Financial Post, Diane Francis, January 30, 2020, https://business.financialpost.com/diane-francis/diane-francis-the-future-is-faster-and-better-than-ever-as-tech-reinvents-the-world

[11] Ibid.

[12] Ibid.

[13] Ibid.

[14] “This time it’s Different”, Howard Marks, Oaktree Capital, June 12, 2019, https://www.oaktreecapital.com/docs/default-source/memos/this-time-its-different.pdf

[15] “Risk Revisited”, Howard Marks, Oaktree Capital, September 3, 2014, https://www.oaktreecapital.com/docs/default-source/memos/2014-09-03-risk-revisited.pdf?sfvrsn=2

[16] The Most Important Thing: Uncommon Sense for the Thoughtful Investor, Howard Marks, 2011

[17] “Am I Being Too Subtle?: Straight Talk From a Business Rebel”, Sam Zell, 2017

[18] “Risk Revisited”, Howard Marks, Oaktree Capital, September 3, 2014, https://www.oaktreecapital.com/docs/default-source/memos/2014-09-03-risk-revisited.pdf?sfvrsn=2

[19] Should I Sell My Stocks?”, Michael Batnick, Ritholtz Wealth Management LLC, February 29, 2020, https://theirrelevantinvestor.com/2020/02/29/should-i-sell-my-stocks/